Schloss Bangalore Limited IPO

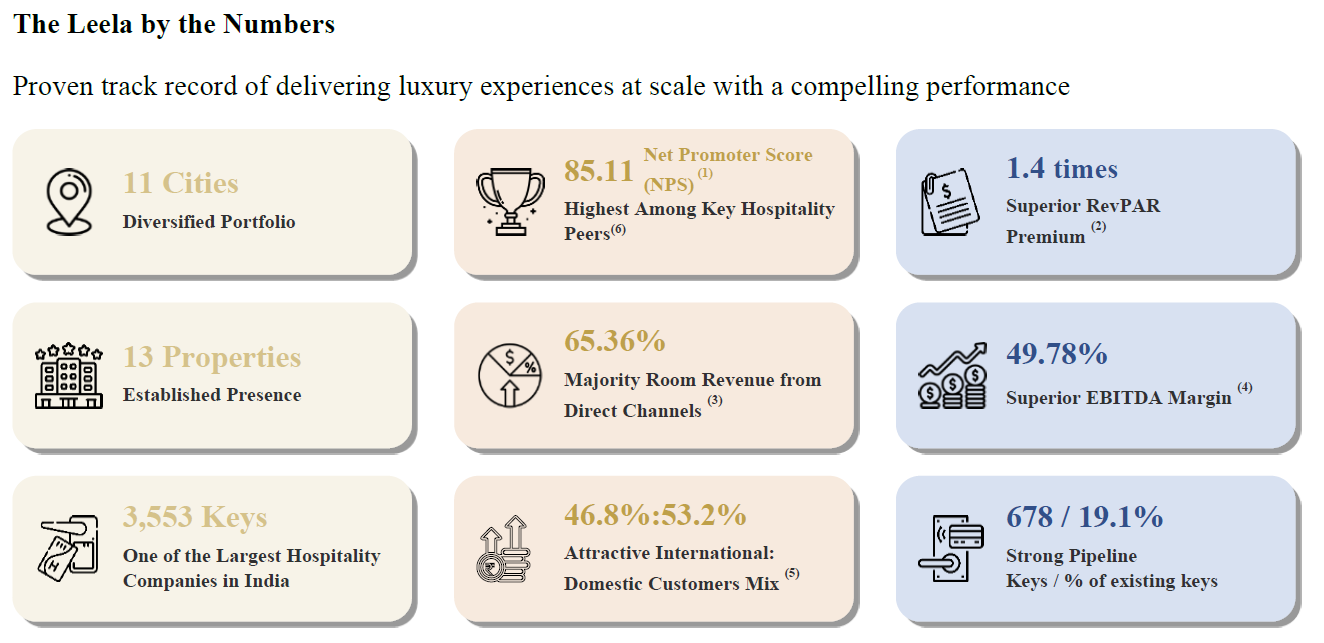

The Leela is a leading luxury hospitality brand in India, known for its Palaces, Hotels, and Resorts. As of March 31, 2025, the brand’s portfolio includes 13 operational properties with a total of 3,553 keys. This comprises five hotels owned directly by The Leela, seven managed under hotel management agreements with third-party owners, and one operated by a third party under a franchise arrangement. The company continues to expand its presence through a mix of ownership, management, and franchise models, delivering premium experiences across its properties.

Price Band₹413 - ₹435 |

Dates26 May - 28 May |

GMP₹4 (0.92%) |

Subscriptions4.50 times |

Issue Size₹3,500.00 Crs |

Leela Hotels IPO Objects

- Repayment of certain outstanding borrowings, interest accrued and prepayment penalties, as applicable

- General corporate purposes

Leela Hotels IPO Details

Price Band₹413 - ₹435 |

Listing AtNSE & BSE |

IPO Issue Type100% Book Built Offer |

Fresh Issue₹2,500.00 Cr (5.75 Cr Shares) |

Offer For Sale₹1,000.00 Cr (2.30 Cr Shares) |

Total Issue₹3,500.00 Cr (8.05 Cr Shares) |

Face Value₹10 per equity share |

Leela Hotels IPO Lot Information

| Investor Category | Lot | Shares | Amount | |

|---|---|---|---|---|

| Retail |

Minimum

1

34

14,790

Maximum

13

442

1,92,270

|

|||

| Small HNI |

Minimum

14

476

2,07,060

Maximum

67

2,278

9,90,930

|

|||

| Big HNI |

Minimum

68

2,312

10,05,720

|

|||

Leela Hotels IPO Subscription

Updated as on 28-May-2025 19:00:00

| Investor Category | Subscription (times) | Shares Offered | Shared Bid |

|---|---|---|---|

| QIB | 7.46 | 2,54,23,729 | 18,96,63,322 |

| NII | 1.02 | 1,27,11,864 | 1,29,96,908 |

| bNII (bids above ₹10L) | 1.15 | 84,74,576 | 97,04,076 |

| sNII (bids between ₹2L to ₹10L) | 0.78 | 42,37,288 | 32,92,832 |

| Retail | 0.83 | 84,74,576 | 70,13,622 |

| Total | 4.50 | 4,66,10,169 | 20,96,73,852 |

Leela Hotels IPO GMP

The estimated Grey Market Premium of Leela Hotels IPO is ₹4 per share (0.92%)

Disclaimer: The GMP prices displayed here reflect news related to grey market trends. We do not trade or deal in the grey market, including subject-to-rates, nor do we recommend participating in grey market trading.

Category Allocation

| Particulars | Allocation |

|---|---|

| QIBs | Not more than 50% of Net Offer |

| Big HNIs (NII) | Not less than 10% of Net Offer |

| Small HNIs (NII) | Not less than 5% of Net Offer |

| Retail | Not less than 35% of Net Offer |

Leela Hotels IPO Financials

| Particulars | Mar-25 | Mar-24 | Mar-23 |

|---|---|---|---|

| Revenue from Operations | 1,300.57 | 1,171.45 | 860.06 |

| Profit after Tax | 47.66 | -2.13 | -61.68 |

| Net Worth | 3,604.99 | -2,825.72 | -2,511.96 |

| Total Borrowing | 3,908.75 | 4,242.18 | 3,696.18 |

| Total Assets | 8,266.16 | 7,061.88 | 5,875.54 |

| NAV per share (in ₹) | 148.88 | -160.57 | -142.74 |

| EPS - Basic (in ₹) | 1.97 | -0.12 | -3.50 |

The financial information presented is on a consolidated basis.

Key Performance Indicators

| KPI | KPI |

|---|---|

| EBITDA | 49.78% |

| PAT | 3.39% |

| Average occupancy | 65.19% |

| RONW | 1.32% |

| Average room rate | 16,408.67 |

| PE Ratio | 220.81 |

| PB Ratio | 2.92 |

| Mkt Cap (in Crs.) | 14,527.17 |

- All the data pertains to FY 2024-25.

- PE, PB, and market capitalization are calculated based on the Upper Price Band.

Leela Hotels IPO Peer Comparision

| Particulars | Schloss Bangalore Limited | Indian Hotels Co. | EIH | Chalet Hotels | Juniper Hotels | Ventive Hospitality |

|---|---|---|---|---|---|---|

| Revenue from Ops (in Crs.) | 1,171.45 | 6,768.75 | 2,511.27 | 1,417.25 | 817.66 | 1,842.07 |

| PAT (In Crs.) | -2.13 | 1,330.24 | 677.71 | 278.18 | 23.80 | -66.75 |

| EPS - Basic | -0.12 | 8.86 | 10.22 | 13.54 | 1.46 | -5.24 |

| NAV per share | -160.57 | 71.16 | 65.34 | 84.74 | 119.34 | 157.13 |

| RONW | NA | 13.13% | 16.58% | 15.03% | 0.90% | -1.82% |

| EBITDA | 48.92% | 33.66% | 39.68% | 42.06% | 38.69% | 45.60% |

| PAT Marginc | -0.17% | 19.14% | 25.81% | 19.36% | 2.88% | -3.50% |

| Price to earning (PE) | -3,625.00 | 86.43 | 36.24 | 59.93 | 197.91 | NA |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of May 7, 2025 for Peers

Leela Hotels IPO Peer Comparision

| Particulars | Schloss Bangalore Limited |

|---|---|

| Revenue from Ops (in Crs.) | 1,171.45 |

| PAT (In Crs.) | -2.13 |

| EPS - Basic | -0.12 |

| NAV per share | -160.57 |

| RONW | NA |

| EBITDA | 48.92% |

| PAT Marginc | -0.17% |

| Price to earning (PE) | -3,625.00 |

| Indian Hotels Co. | EIH | Chalet Hotels | Juniper Hotels | Ventive Hospitality |

|---|---|---|---|---|

| 6,768.75 | 2,511.27 | 1,417.25 | 817.66 | 1,842.07 |

| 1,330.24 | 677.71 | 278.18 | 23.80 | -66.75 |

| 8.86 | 10.22 | 13.54 | 1.46 | -5.24 |

| 71.16 | 65.34 | 84.74 | 119.34 | 157.13 |

| 13.13% | 16.58% | 15.03% | 0.90% | -1.82% |

| 33.66% | 39.68% | 42.06% | 38.69% | 45.60% |

| 19.14% | 25.81% | 19.36% | 2.88% | -3.50% |

| 86.43 | 36.24 | 59.93 | 197.91 | NA |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of May 7, 2025 for Peers

Promoter Details

| Name | Shareholding |

|---|---|

| Promoters Project Ballet Bangalore Holdings | 63.65% |

| BSREP III Tadoba Holdings | 15.81% |

| Project Ballet HMA Holdings | 7.10% |

| Project Ballet Chennai Holdings | 5.91% |

| BSREP III Joy (Two) Holdings | 4.08% |

| Project Ballet Udaipur Holdings | 2.42% |

| Project Ballet Gandhinagar Holdings | 1.03% |

Management Details

| Name | Designation |

|---|---|

| Deepak Parekh | Chairman |

| Anuraag Bhatnagar | CEO |

| Ravi Shankar | CFO |

Company Details

Name: Schloss Bangalore Limited

Address: The Leela Palace, Diplomatic Enclave, Africa Avenue, Netaji Nagar, South Delhi, New Delhi, Delhi, 110 023, India

Number: +91 22 6901 5454

Email: cs@theleela.com

Website: www.theleela.com

Book Running Lead Managers (BRLMs)

ICICI Securities

Visit Website

Axis Capital

Visit Website

SBI Capital

Visit Website

Morgan Stanley

Visit Website

JM Financial

Visit Website

Kotak Mahindra Capital

Visit Website

Citigroup Global

Visit Website

IIFL Capital Services

Visit Website

Motilal Oswal Investment

Visit Website

Bofa Securities

Visit Website

J.P. Morgan

Visit WebsiteRTAs

KFin Technologies

Visit WebsiteFrequently Asked questions?

Find answers to common questions that come in your mind related to IPO.

Leela Hotels IPO is a Mainboard IPO having an issue size of Rs. ₹3,500.00 Crs. Leela Hotels IPO is priced at ₹413 - ₹435 per share. The issue opens on 26 May 25 and closes on 28 May 25.

Leela Hotels IPO opens on 26 May 25 and closes on 28 May 25.

The estimated Grey Market Premium of Leela Hotels IPO is ₹4 per share (0.92%).

The minimum lot size of Leela Hotels IPO is 34 shares & the minimum application amount is Rs. 14790.

The allotment date of Leela Hotels IPO is 29 May 25.

The listing date of Leela Hotels IPO is 02 Jun 25.

Leela Hotels IPO is subscribed 4.50 times.

Leela Hotels IPO is priced at ₹413 - ₹435 per share.

Click the allotment link on Leela Hotels IPO page of IPO360.

- Go to Kite App → Tap on Bids → Tap on IPO

- Select the IPO → Tap on apply → Enter UPI ID

- Enter Qty and Price

- Submit the application

- Approve the UPI Mandate on your UPI app

- Go to Groww App → Stocks Section → Select IPO option

- Select the IPO you want to apply

- Enter your bid details and price

- Enter UPI ID & submit

- Approve the UPI Mandate on your UPI app

- Log in to your bank's net banking portal.

- Navigate to the 'IPO' or 'ASBA' section.

- Select Leela Hotels IPO from the list of available IPOs.

- Enter the required details: Bid quantity, Price, DP ID & Client ID, etc

- Submit the application.

- Money will remain blocked till the refund date