Sambhv Steel Tubes Limited IPO

According to the CRISIL Report, the company is among the leading manufacturers of electric resistance welded (ERW) steel pipes and structural tubes (hollow sections) in India by installed capacity as of March 31, 2024. It is one of only two players producing ERW pipes using narrow-width HR coils (as of December 31, 2024). With backward integration, it manufactures a wide range of products including ERW black pipes, GP pipes, GI pipes, CRFH pipes, and steel door frames. These rust-resistant products serve sectors such as housing, infrastructure, water, agriculture, telecom, oil & gas, and solar. The company has a robust distribution network across 15 states and one union territory.

Price Band₹77 - ₹82 |

Dates25 Jun - 27 Jun |

GMP₹13 (15.85%) |

Subscriptions28.46 times |

Issue Size₹540.00 Crs |

Sambhv Steel Tubes IPO Objects

- Pre-payment of a portion of certain outstanding borrowings availed by our Company

- General corporate purposes

Sambhv Steel Tubes IPO Details

Price Band₹77 - ₹82 |

Listing AtNSE & BSE |

IPO Issue Type100% Book Built Offer |

Fresh Issue₹440.00 Cr (5.37 Cr Shares) |

Offer For Sale₹100.00 Cr (1.22 Cr Shares) |

Total Issue₹540.00 Cr (6.59 Cr Shares) |

Face Value₹10 per equity share |

Sambhv Steel Tubes IPO Lot Information

| Investor Category | Lot | Shares | Amount | |

|---|---|---|---|---|

| Retail |

Minimum

1

182

14,924

Maximum

13

2,366

1,94,012

|

|||

| Small HNI |

Minimum

14

2,548

2,08,936

Maximum

67

12,194

9,99,908

|

|||

| Big HNI |

Minimum

68

12,376

10,14,832

|

|||

Sambhv Steel Tubes IPO Subscription

Updated as on 27-Jun-2025 19:00:00

| Investor Category | Subscription (times) | Shares Offered | Shared Bid |

|---|---|---|---|

| QIB | 62.32 | 1,39,61,038 | 86,99,84,024 |

| NII | 31.82 | 1,04,70,779 | 33,31,74,478 |

| bNII (bids above ₹10L) | 33.64 | 69,80,520 | 23,48,23,862 |

| sNII (bids between ₹2L to ₹10L) | 28.18 | 34,90,259 | 9,83,50,616 |

| Retail | 7.99 | 2,44,31,818 | 19,52,63,978 |

| Employee | 5.34 | 3,42,465 | 18,29,828 |

| Total | 28.46 | 4,92,06,100 | 1,40,02,52,308 |

Sambhv Steel Tubes IPO GMP

The estimated Grey Market Premium of Sambhv Steel Tubes IPO is ₹13 per share (15.85%)

Category Allocation

| Particulars | Allocation |

|---|---|

| QIBs | Not more than 50% of Net Offer |

| Big HNIs (NII) | Not less than 10% of Net Offer |

| Small HNIs (NII) | Not less than 5% of Net Offer |

| Retail | Not less than 35% of Net Offer |

| Employee | Rs. 2.5 Cr |

Sambhv Steel Tubes IPO Financials

| Particulars | Dec-24 | Mar-24 | Mar-23 | Mar-22 |

|---|---|---|---|---|

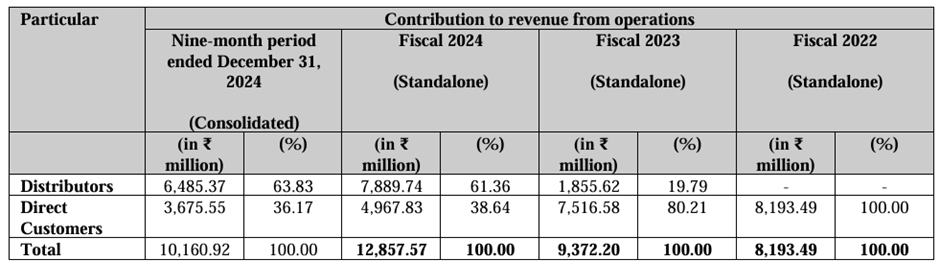

| Revenue from Operations | 1,016.09 | 1,285.76 | 937.22 | 819.35 |

| Profit after Tax | 40.69 | 82.44 | 60.38 | 72.11 |

| Net Worth | 478.46 | 438.28 | 210.40 | 149.30 |

| Total Borrowing | 619.15 | 346.88 | 282.77 | 241.29 |

| Total Assets | 1,411.82 | 940.13 | 552.14 | 458.51 |

| NAV per share (in ₹) | 19.85 | 18.19 | 10.47 | 7.43 |

| EPS - Basic (in ₹) | 1.69 | 3.79 | 3.01 | 3.59 |

The financial information presented is on a consolidated basis.

Key Performance Indicators

| KPI | KPI |

|---|---|

| EBITDA | 12.43% |

| PAT | 6.41% |

| ROE | 25.42% |

| ROCE | 17.66% |

| Debt to Equity | 0.80 |

| PE Ratio | 21.64 |

| PB Ratio | 4.51 |

| Mkt Cap (in Crs.) | 2,020.22 |

- All the data pertains to FY 2023-24.

- PE, PB, and market capitalization are calculated based on the Upper Price Band.

Sambhv Steel Tubes IPO Peer Comparision

| Particulars | Sambhv Steel Tubes | APL Apollo Tubes | Hariom Pipes Industries | Hi-Tech Pipes | JTL Industries | Rama Steel Tubes | Surya Roshni |

|---|---|---|---|---|---|---|---|

| Revenue from Ops (in Crs.) | 1,285.76 | 18,118.80 | 1,153.19 | 2,699.29 | 2,040.23 | 1,046.51 | 7,809.27 |

| PAT (In Crs.) | 82.44 | 732.44 | 56.80 | 43.93 | 113.01 | 30.00 | 329.16 |

| EPS - Basic | 3.79 | 26.40 | 20.34 | 3.25 | 6.63 | 0.50 | 30.51 |

| NAV per share | 18.19 | 129.60 | 160.50 | 38.20 | 43.72 | 2.14 | 187.63 |

| RONW | 25.42% | 22.21% | 13.56% | 8.90% | 19.15% | 10.40% | 17.41% |

| EBITDA | 12.43% | 6.58% | 12.02% | 4.26% | 7.46% | 5.74% | 7.33% |

| PAT Margin | 6.41% | 4.04% | 4.93% | 1.63% | 5.54% | 2.87% | 4.21% |

| Price to earning (PE) | 21.64 | 68.52 | 21.15 | 35.52 | 10.16 | 24.27 | 10.98 |

| Debt to Equity | 0.80 | 0.32 | 0.80 | 0.63 | 0.03 | 0.43 | 0.01 |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of June 2, 2025 for Peers

Sambhv Steel Tubes IPO Peer Comparision

| Particulars | Sambhv Steel Tubes |

|---|---|

| Revenue from Ops (in Crs.) | 1,285.76 |

| PAT (In Crs.) | 82.44 |

| EPS - Basic | 3.79 |

| NAV per share | 18.19 |

| RONW | 25.42% |

| EBITDA | 12.43% |

| PAT Margin | 6.41% |

| Price to earning (PE) | 21.64 |

| Debt to Equity | 0.80 |

| APL Apollo Tubes | Hariom Pipes Industries | Hi-Tech Pipes | JTL Industries | Rama Steel Tubes | Surya Roshni |

|---|---|---|---|---|---|

| 18,118.80 | 1,153.19 | 2,699.29 | 2,040.23 | 1,046.51 | 7,809.27 |

| 732.44 | 56.80 | 43.93 | 113.01 | 30.00 | 329.16 |

| 26.40 | 20.34 | 3.25 | 6.63 | 0.50 | 30.51 |

| 129.60 | 160.50 | 38.20 | 43.72 | 2.14 | 187.63 |

| 22.21% | 13.56% | 8.90% | 19.15% | 10.40% | 17.41% |

| 6.58% | 12.02% | 4.26% | 7.46% | 5.74% | 7.33% |

| 4.04% | 4.93% | 1.63% | 5.54% | 2.87% | 4.21% |

| 68.52 | 21.15 | 35.52 | 10.16 | 24.27 | 10.98 |

| 0.32 | 0.80 | 0.63 | 0.03 | 0.43 | 0.01 |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of June 2, 2025 for Peers

Promoter Details

| Name | Shareholding |

|---|---|

| Brijlal Goyal | 7.69% |

| Suresh Kumar Goyal | 7.69% |

| Vikas Kumar Goyal | 7.69% |

| Sheetal Goyal | 7.92% |

| Other promoter | 40.91% |

| Total | 71.93% |

Management Details

| Name | Designation |

|---|---|

| Suresh Kumar Goyal | Chairman |

| Vikas Kumar Goyal | MD & CEO |

| Bhavesh Khetan | CFO |

Company Details

Name: Sambhv Steel Tubes Limited

Address: Office No. 501 to 511, Harshit Corporate, Amanaka, Raipur 492 001, Chhattisgarh, India

Number: +91 771 2222 360

Email: cs@sambhv.com

Website: www.sambhv.com

Book Running Lead Managers (BRLMs)

Motilal Oswal Investment

Visit Website

Nuvama Wealth

Visit WebsiteRTAs

KFin Technologies

Visit WebsiteFrequently Asked questions?

Find answers to common questions that come in your mind related to IPO.

Sambhv Steel Tubes IPO is a Mainboard IPO having an issue size of Rs. ₹540.00 Crs. Sambhv Steel Tubes IPO is priced at ₹77 - ₹82 per share. The issue opens on 25 Jun 25 and closes on 27 Jun 25.

Sambhv Steel Tubes IPO opens on 25 Jun 25 and closes on 27 Jun 25.

The estimated Grey Market Premium of Sambhv Steel Tubes IPO is ₹13 per share (15.85%).

The minimum lot size of Sambhv Steel Tubes IPO is 182 shares & the minimum application amount is Rs. 14924.

The allotment date of Sambhv Steel Tubes IPO is 30 Jun 25.

The listing date of Sambhv Steel Tubes IPO is 02 Jul 25.

Sambhv Steel Tubes IPO is subscribed 28.46 times.

Sambhv Steel Tubes IPO is priced at ₹77 - ₹82 per share.

Click the allotment link on Sambhv Steel Tubes IPO page of IPO360.

- Go to Kite App → Tap on Bids → Tap on IPO

- Select the IPO → Tap on apply → Enter UPI ID

- Enter Qty and Price

- Submit the application

- Approve the UPI Mandate on your UPI app

- Go to Groww App → Stocks Section → Select IPO option

- Select the IPO you want to apply

- Enter your bid details and price

- Enter UPI ID & submit

- Approve the UPI Mandate on your UPI app

- Log in to your bank's net banking portal.

- Navigate to the 'IPO' or 'ASBA' section.

- Select Sambhv Steel Tubes IPO from the list of available IPOs.

- Enter the required details: Bid quantity, Price, DP ID & Client ID, etc

- Submit the application.

- Money will remain blocked till the refund date