Kalpataru Limited IPO

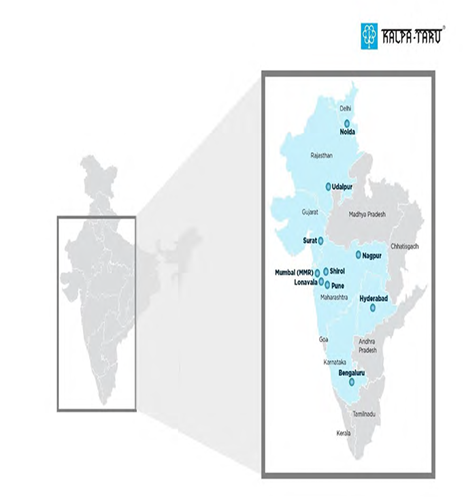

Kalpataru is a prominent and integrated real estate development company with a strong presence across all key micro-markets of the Mumbai Metropolitan Region (MMR). The co. is an actively involved in the complete real estate lifecycle—from identifying and acquiring land or development rights, to planning, designing, executing, marketing, and selling our projects. They have a diverse portfolio spans luxury, premium, and mid-income residential developments, commercial and retail spaces, integrated townships, lifestyle-oriented gated communities, and urban redevelopment projects, all aimed at delivering high-quality living and working spaces.

Price Band₹387 - ₹414 |

Dates24 Jun - 26 Jun |

GMP₹1 (0.24%) |

Subscriptions2.26 times |

Issue Size₹1,590.00 Crs |

Kalpataru IPO Objects

- Payment in full or in part of certain borrowings availed by Company

- General Corporate Purposes

Kalpataru IPO Details

Price Band₹387 - ₹414 |

Listing AtNSE & BSE |

IPO Issue Type100% Book Built Offer |

Fresh Issue₹1,590.00 Cr (3.84 Cr Shares) |

Offer For Sale₹0.00 (0.00 Shares) |

Total Issue₹1,590.00 Cr (3.84 Cr Shares) |

Face Value₹10 per equity share |

Kalpataru IPO Lot Information

| Investor Category | Lot | Shares | Amount | |

|---|---|---|---|---|

| Retail |

Minimum

1

36

14,904

Maximum

13

468

1,93,752

|

|||

| Small HNI |

Minimum

14

504

2,08,656

Maximum

67

2,412

9,98,568

|

|||

| Big HNI |

Minimum

68

2,448

10,13,472

|

|||

Kalpataru IPO Subscription

Updated as on 26-Jun-2025 19:00:00

| Investor Category | Subscription (times) | Shares Offered | Shared Bid |

|---|---|---|---|

| QIB | 3.12 | 1,22,02,326 | 3,80,15,100 |

| NII | 1.31 | 61,01,162 | 79,72,380 |

| bNII (bids above ₹10L) | 1.58 | 40,67,442 | 64,26,900 |

| sNII (bids between ₹2L to ₹10L) | 0.76 | 20,33,720 | 15,45,480 |

| Retail | 1.29 | 40,67,441 | 52,66,728 |

| Employee | 0.70 | 4,55,587 | 3,19,968 |

| Total | 2.26 | 2,28,26,516 | 5,15,74,176 |

Kalpataru IPO GMP

The estimated Grey Market Premium of Kalpataru IPO is ₹1 per share (0.24%)

Disclaimer: The GMP prices displayed here reflect news related to grey market trends. We do not trade or deal in the grey market, including subject-to-rates, nor do we recommend participating in grey market trading.

Category Allocation

| Particulars | Allocation |

|---|---|

| QIBs | Not more than 50% of Net Offer |

| Big HNIs (NII) | Not less than 10% of Net Offer |

| Small HNIs (NII) | Not less than 5% of Net Offer |

| Retail | Not less than 35% of Net Offer |

| Employee | 4.23 Lac EQ Shares |

Kalpataru IPO Financials

| Particulars | Dec-24 | Mar-24 | Mar-23 | Mar-22 |

|---|---|---|---|---|

| Revenue from Operations | 1,624.74 | 1,929.98 | 3,633.18 | 1,000.67 |

| Profit after Tax | 5.51 | -116.51 | -229.43 | -125.36 |

| Net Worth | 1,579.54 | 1,018.86 | 1,215.23 | 1,425.00 |

| Total Borrowing | 11,056.40 | 10,688.31 | 9,679.64 | 10,365.97 |

| Total Assets | 15,562.35 | 13,870.07 | 12,534.11 | 13,406.56 |

| NAV per share (in ₹) | 113.11 | 72.96 | 87.02 | 102.04 |

| EPS - Basic (in ₹) | 0.62 | -7.41 | -14.56 | -8.92 |

The financial information presented is on a consolidated basis.

Key Performance Indicators

| KPI | Values |

|---|---|

| Adj EBITDA | 23.25% |

| PE Ratio | NA |

| PB Ratio | 5.67 |

| Mkt Cap (in Crs.) | 8,525.67 |

- All the data pertains to FY 2023-24.

- PE, PB, and market capitalization are calculated based on the Upper Price Band.

Kalpataru IPO Peer Comparision

| Particulars | Kalpataru | Oberoi | Macrotech | Godrej | Suntech | Mahindra Lifespace | Keystone | Prestige |

|---|---|---|---|---|---|---|---|---|

| Revenue from Ops (in Crs.) | 1,929.98 | 4,495.79 | 10,316.10 | 3,035.62 | 564.85 | 212.09 | 2,222.25 | 7,877.10 |

| EBITDA (In Crs.) | -78.01 | 2,409.87 | 2,675.70 | 1,196.66 | 117.29 | 75.40 | 162.92 | 2,498.40 |

| EPS - Basic | -7.41 | 52.99 | 16.03 | 26.09 | 4.99 | 6.34 | 9.85 | 34.28 |

| NAV per share | 72.96 | 380.76 | 175.66 | 359.39 | 213.28 | 120.82 | 157.85 | 281.59 |

| RONW | NA | 13.92% | 8.87% | 7.26% | 2.27% | 5.25% | 6.24% | 12.17% |

| EBITDA Margin | -4.04% | 53.60% | 25.94% | 39.42% | 20.77% | 35.55% | 7.33% | 31.72% |

| Price to earning (PE) | NA | 35.91 | 90.84 | 92.10 | 89.64 | 56.71 | 56.97 | 48.31 |

- All information pertains to FY 2023-24.

- PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of June 13, 2025 for Peers

Kalpataru IPO Peer Comparision

| Particulars | Kalpataru |

|---|---|

| Revenue from Ops (in Crs.) | 1,929.98 |

| EBITDA (In Crs.) | -78.01 |

| EPS - Basic | -7.41 |

| NAV per share | 72.96 |

| RONW | NA |

| EBITDA Margin | -4.04% |

| Price to earning (PE) | NA |

| Oberoi | Macrotech | Godrej | Suntech | Mahindra Lifespace | Keystone | Prestige |

|---|---|---|---|---|---|---|

| 4,495.79 | 10,316.10 | 3,035.62 | 564.85 | 212.09 | 2,222.25 | 7,877.10 |

| 2,409.87 | 2,675.70 | 1,196.66 | 117.29 | 75.40 | 162.92 | 2,498.40 |

| 52.99 | 16.03 | 26.09 | 4.99 | 6.34 | 9.85 | 34.28 |

| 380.76 | 175.66 | 359.39 | 213.28 | 120.82 | 157.85 | 281.59 |

| 13.92% | 8.87% | 7.26% | 2.27% | 5.25% | 6.24% | 12.17% |

| 53.60% | 25.94% | 39.42% | 20.77% | 35.55% | 7.33% | 31.72% |

| 35.91 | 90.84 | 92.10 | 89.64 | 56.71 | 56.97 | 48.31 |

- All information pertains to FY 2023-24.

- PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of June 13, 2025 for Peers

Promoter Details

| Name | Shareholding |

|---|---|

| Mofatraj Munot | 21.68% |

| Parag Munot | 12.12% |

| Kalpataru Construction | 11.02% |

| Others | 55.18% |

| Total | 100.00% |

Management Details

| Name | Designation |

|---|---|

| Parag Munot | Managing Director |

| Chandrashekhar Joglekar | CFO |

Company Details

Name: Kalpataru Limited

Address: 91, Kalpataru Synergy, opposite Grand Hyatt,

Santacruz (East), Mumbai 400 055, Maharashtra, India

Number: +91 22 3064 5000

Email: investor.cs@kalpataru.com

Website: www.kalpataru.com

Book Running Lead Managers (BRLMs)

RTAs

MUFG Intime India

Visit WebsiteFrequently Asked questions?

Find answers to common questions that come in your mind related to IPO.

Kalpataru IPO is a Mainboard IPO having an issue size of Rs. ₹1,590.00 Crs. Kalpataru IPO is priced at ₹387 - ₹414 per share. The issue opens on 24 Jun 25 and closes on 26 Jun 25.

Kalpataru IPO opens on 24 Jun 25 and closes on 26 Jun 25.

The estimated Grey Market Premium of Kalpataru IPO is ₹1 per share (0.24%).

The minimum lot size of Kalpataru IPO is 36 shares & the minimum application amount is Rs. 14904.

The allotment date of Kalpataru IPO is 27 Jun 25.

The listing date of Kalpataru IPO is 01 Jul 25.

Kalpataru IPO is subscribed 2.26 times.

Kalpataru IPO is priced at ₹387 - ₹414 per share.

Click the allotment link on Kalpataru IPO page of IPO360.

- Go to Kite App → Tap on Bids → Tap on IPO

- Select the IPO → Tap on apply → Enter UPI ID

- Enter Qty and Price

- Submit the application

- Approve the UPI Mandate on your UPI app

- Go to Groww App → Stocks Section → Select IPO option

- Select the IPO you want to apply

- Enter your bid details and price

- Enter UPI ID & submit

- Approve the UPI Mandate on your UPI app

- Log in to your bank's net banking portal.

- Navigate to the 'IPO' or 'ASBA' section.

- Select Kalpataru IPO from the list of available IPOs.

- Enter the required details: Bid quantity, Price, DP ID & Client ID, etc

- Submit the application.

- Money will remain blocked till the refund date