Crizac Limited IPO

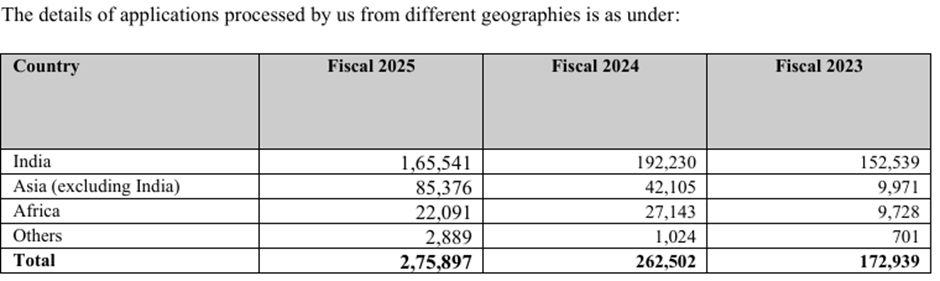

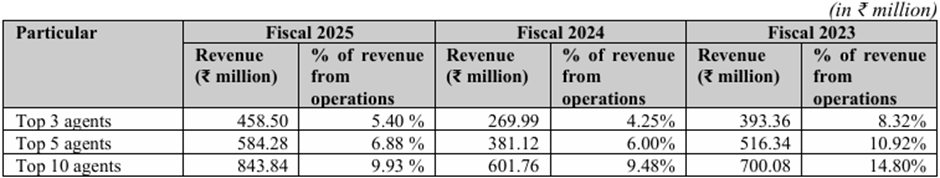

Crizac Limited is a B2B education platform that partners with agents and global institutions to provide international student recruitment solutions across the UK, Canada, Ireland, Australia, and New Zealand. With a strong focus on student recruitment from India to the UK, the company has built long-standing relationships with top institutions. By working closely with global universities, it develops customized strategies aligned with each institution’s recruitment goals and strengths.

Price Band₹233 - ₹245 |

Dates02 Jul - 04 Jul |

GMP₹32 (13.06%) |

Subscriptions59.82 times |

Issue Size₹860.00 Crs |

Crizac IPO Objects

- The issue is a complete Offer for Sale (OFS). The company will not receive any funds from the issue, entire proceeds will be received by the Selling Shareholder(s).

Crizac IPO Details

Price Band₹233 - ₹245 |

Listing AtNSE & BSE |

IPO Issue Type100% Book Built Offer |

Fresh Issue₹0.00 (0.00 Shares) |

Offer For Sale₹860.00 Cr (3.51 Cr Shares) |

Total Issue₹860.00 Cr (3.51 Cr Shares) |

Face Value₹2 per equity share |

Crizac IPO Lot Information

| Investor Category | Lot | Shares | Amount | |

|---|---|---|---|---|

| Retail |

Minimum

1

61

14,945

Maximum

13

793

1,94,285

|

|||

| Small HNI |

Minimum

14

854

2,09,230

Maximum

66

4,026

9,86,370

|

|||

| Big HNI |

Minimum

67

4,087

10,01,315

|

|||

Crizac IPO Subscription

Updated as on 04-Jul-2025 19:00:00

| Investor Category | Subscription (times) | Shares Offered | Shared Bid |

|---|---|---|---|

| QIB | 134.35 | 73,81,973 | 99,17,49,956 |

| NII | 76.15 | 55,36,481 | 42,16,26,754 |

| bNII (bids above ₹10L) | 88.40 | 36,90,988 | 32,62,66,491 |

| sNII (bids between ₹2L to ₹10L) | 51.67 | 18,45,493 | 9,53,60,263 |

| Retail | 10.24 | 1,29,18,455 | 13,23,03,754 |

| Total | 59.82 | 2,58,36,909 | 1,54,56,80,464 |

Crizac IPO GMP

The estimated Grey Market Premium of Crizac IPO is ₹32 per share (13.06%)

Category Allocation

| Particulars | Allocation |

|---|---|

| QIBs | Not more than 50% of Net Offer |

| Big HNIs (NII) | Not less than 10% of Net Offer |

| Small HNIs (NII) | Not less than 5% of Net Offer |

| Retail | Not less than 35% of Net Offer |

Crizac IPO Financials

| Particulars | Mar-25 | Mar-24 | Mar-23 |

|---|---|---|---|

| Revenue from Operations | 849.49 | 530.05 | 274.10 |

| Profit after Tax | 152.93 | 117.92 | 110.11 |

| Net Worth | 503.33 | 339.44 | 219.97 |

| Total Borrowing | 0.08 | 0.08 | 0.08 |

| Total Assets | 877.74 | 591.03 | 232.06 |

| NAV per share (in ₹) | 28.76 | 19.40 | 12.57 |

| EPS - Basic (in ₹) | 8.74 | 6.74 | 6.29 |

The financial information presented is on a consolidated basis.

Key Performance Indicators

| KPI | Values |

|---|---|

| EBITDA | 25.05% |

| PAT | 17.28% |

| ROE | 30.38% |

| PE Ratio | 28.03 |

| PB Ratio | 8.52 |

| Mkt Cap (in Crs.) | 4,287.07 |

- All the data pertains to Mar-25.

- PE, PB, and market capitalization are calculated based on the Upper Price Band.

Crizac IPO Peer Comparision

| Particulars | Crizac | Indiamart Intermesh |

|---|---|---|

| Revenue from Ops (in Crs.) | 849.49 | 1,388.34 |

| PAT (In Crs.) | 152.93 | 550.70 |

| EPS - Basic | 8.74 | 91.84 |

| NAV per share | 28.76 | 363.43 |

| RONW | 30.38% | 25.20% |

| EBITDA | 25.05% | 34.12% |

| PAT Margin | 17.28% | 33.16% |

| Price to earning (PE) | 28.03 | 27.18 |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of June 10, 2025 for Peers

Crizac IPO Peer Comparision

| Particulars | Crizac |

|---|---|

| Revenue from Ops (in Crs.) | 849.49 |

| PAT (In Crs.) | 152.93 |

| EPS - Basic | 8.74 |

| NAV per share | 28.76 |

| RONW | 30.38% |

| EBITDA | 25.05% |

| PAT Margin | 17.28% |

| Price to earning (PE) | 28.03 |

| Indiamart Intermesh |

|---|

| 1,388.34 |

| 550.70 |

| 91.84 |

| 363.43 |

| 25.20% |

| 34.12% |

| 33.16% |

| 27.18 |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of June 10, 2025 for Peers

Promoter Details

| Name | Shareholding |

|---|---|

| Pinky Agarwal | 46.93% |

| Manish Agarwal | 30.56% |

| Vikash Agarwal | 2.99% |

| Other promter | 19.52% |

| Total | 100.00% |

Management Details

| Name | Designation |

|---|---|

| Vikash Agarwal | Chairman & MD |

| Manish Agarwal | CFO |

| Christopher Nagle | CEO |

Company Details

Name: Crizac Limited

Address: Wing A, 3rd Floor, Constantia Building, 11, Dr. U.N. Brahmachari Street, Shakespeare Sarani, Kolkata, West Bengal, India - 700017

Number: +91 33 3544 1515

Email: compliance@crizac.com

Website: www.crizac.com

Book Running Lead Managers (BRLMs)

Equirus Capital

Visit Website

Anand Rathi Securities

Visit WebsiteRTAs

MUFG Intime India

Visit WebsiteFrequently Asked questions?

Find answers to common questions that come in your mind related to IPO.

Crizac IPO is a Mainboard IPO having an issue size of Rs. ₹860.00 Crs. Crizac IPO is priced at ₹233 - ₹245 per share. The issue opens on 02 Jul 25 and closes on 04 Jul 25.

Crizac IPO opens on 02 Jul 25 and closes on 04 Jul 25.

The estimated Grey Market Premium of Crizac IPO is ₹32 per share (13.06%).

The minimum lot size of Crizac IPO is 61 shares & the minimum application amount is Rs. 14945.

The allotment date of Crizac IPO is 07 Jul 25.

The listing date of Crizac IPO is 09 Jul 25.

Crizac IPO is subscribed 59.82 times.

Crizac IPO is priced at ₹233 - ₹245 per share.

Click the allotment link on Crizac IPO page of IPO360.

- Go to Kite App → Tap on Bids → Tap on IPO

- Select the IPO → Tap on apply → Enter UPI ID

- Enter Qty and Price

- Submit the application

- Approve the UPI Mandate on your UPI app

- Go to Groww App → Stocks Section → Select IPO option

- Select the IPO you want to apply

- Enter your bid details and price

- Enter UPI ID & submit

- Approve the UPI Mandate on your UPI app

- Log in to your bank's net banking portal.

- Navigate to the 'IPO' or 'ASBA' section.

- Select Crizac IPO from the list of available IPOs.

- Enter the required details: Bid quantity, Price, DP ID & Client ID, etc

- Submit the application.

- Money will remain blocked till the refund date