Aegis Vopak Terminals Limited IPO

Aegis Vopak Terminals Limited is the largest Indian third-party owner and operator of tank storage terminals for liquified petroleum gas (LPG) and liquid products by storage capacity, as of June 30, 2024 . The company operates a network with approximately 1.50 million cubic meters of liquid storage and 70,800 MT of LPG capacity. Its facilities handle petroleum, chemicals, vegetable oils, lubricants, and gases. With terminals across five key ports, the company manages ~26.64% of India’s third-party liquid storage and ~12.23% of LPG static capacity, supported by integrated infrastructure for multi-modal evacuation.

Price Band₹223 - ₹235 |

Dates26 May - 28 May |

GMP₹2 (0.85%) |

Subscriptions2.09 times |

Issue Size₹3,500.00 Crs |

Aegis Terminals IPO Objects

- Repayment of certain outstanding borrowings availed by our Company

- Funding capital expenditure towards contracted acquisition of the cryogenic LPG terminal

- General corporate purposes

Aegis Terminals IPO Details

Price Band₹223 - ₹235 |

Listing AtNSE & BSE |

IPO Issue Type100% Book Built Offer |

Fresh Issue₹3,500.00 Cr (14.89 Cr Shares) |

Offer For Sale₹0.00 (0.00 Shares) |

Total Issue₹3,500.00 Cr (14.89 Cr Shares) |

Face Value₹10 per equity share |

Aegis Terminals IPO Lot Information

| Investor Category | Lot | Shares | Amount | |

|---|---|---|---|---|

| Retail |

Minimum

1

63

14,805

Maximum

13

819

1,92,465

|

|||

| Small HNI |

Minimum

14

882

2,07,270

Maximum

67

4,221

9,91,935

|

|||

| Big HNI |

Minimum

68

4,284

10,06,740

|

|||

Aegis Terminals IPO Subscription

Updated as on 28-May-2025 19:00:00

| Investor Category | Subscription (times) | Shares Offered | Shared Bid |

|---|---|---|---|

| QIB | 3.30 | 3,76,68,163 | 12,42,01,476 |

| NII | 0.56 | 1,88,34,080 | 1,04,93,280 |

| bNII (bids above ₹10L) | 0.57 | 1,25,56,053 | 71,44,515 |

| sNII (bids between ₹2L to ₹10L) | 0.53 | 62,78,027 | 33,48,765 |

| Retail | 0.77 | 1,25,56,053 | 96,78,186 |

| Total | 2.09 | 6,90,58,296 | 14,43,72,942 |

Aegis Terminals IPO GMP

The estimated Grey Market Premium of Aegis Terminals IPO is ₹2 per share (0.85%)

Disclaimer: The GMP prices displayed here reflect news related to grey market trends. We do not trade or deal in the grey market, including subject-to-rates, nor do we recommend participating in grey market trading.

Category Allocation

| Particulars | Allocation |

|---|---|

| QIB | Not less than 75% of Net Offer |

| Big HNIs (NII) | Not more than 10% of Net Offer |

| Small HNIs (NII) | Not more than 5% of Net Offer |

| Retail | Not more than 0% of Net Offer |

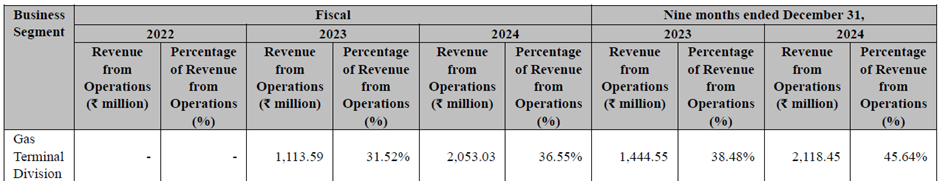

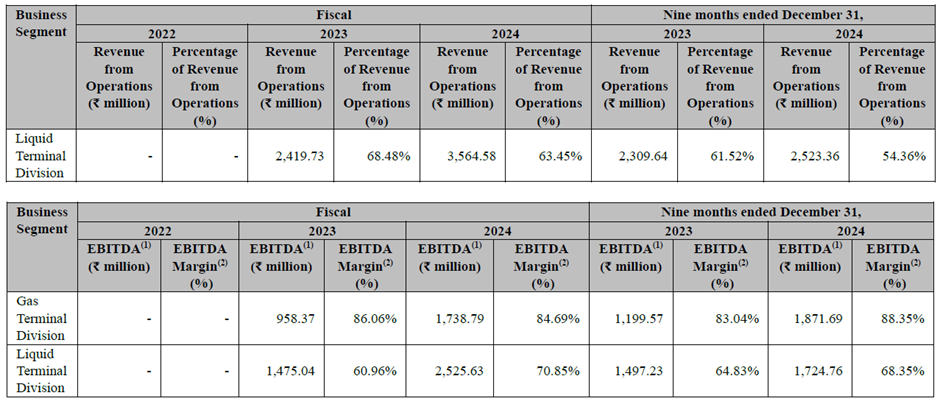

Aegis Terminals IPO Financials

| Particulars | Dec-24 | Mar-24 | Mar-23 | Mar-22 |

|---|---|---|---|---|

| Revenue from Operations | 464.18 | 561.76 | 353.33 | 0.00 |

| Profit after Tax | 85.89 | 86.54 | -0.08 | -1.09 |

| Net Worth | 2,037.61 | 1,151.94 | 1,098.20 | -0.53 |

| Total Borrowing | 2,485.75 | 2,586.42 | 1,745.17 | 98.10 |

| Total Assets | 5,855.60 | 4,523.40 | 3,481.48 | 102.56 |

| NAV per share (in ₹) | 20.61 | 13.27 | 12.65 | -0.01 |

| EPS - Basic (in ₹) | 0.92 | 1.00 | - | -0.03 |

The financial information presented is on a consolidated basis.

Key Performance Indicators

| KPI | Values |

|---|---|

| EBITDA | 71.19% |

| PAT | 15.18% |

| ROE | 8.68% |

| ROCE | 8.39% |

| Debt to Equity | 2.59 |

| PE Ratio | 235.00 |

| PB Ratio | 17.71 |

| Mkt Cap (in Crs.) | 26,737.80 |

- All the data pertains to FY 2023-24

- PE, PB, and market capitalization are calculated based on the Upper Price Band

Aegis Terminals IPO Peer Comparision

| Particulars | Aegis Terminals | Adani Ports | JSW Infra |

|---|---|---|---|

| Revenue from Ops (in Crs.) | 561.76 | 26,710.56 | 3,762.89 |

| PAT (In Crs.) | 86.54 | 8,103.99 | 1,160.69 |

| EPS - Basic | 1.00 | 37.55 | 5.88 |

| NAV per share | 13.27 | 245.10 | 41.77 |

| RONW | 7.51% | 15.32% | 14.40% |

| EBITDA | 70.77% | 59.39% | 52.21% |

| PAT Margin | 15.18% | 28.73% | 28.78% |

| Price to earning (PE) | 235.00 | 37.48 | 49.02 |

| Debt to Equity | 2.59 | 0.85 | 0.53 |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of May 16, 2025 for Peers

Aegis Terminals IPO Peer Comparision

| Particulars | Aegis Terminals |

|---|---|

| Revenue from Ops (in Crs.) | 561.76 |

| PAT (In Crs.) | 86.54 |

| EPS - Basic | 1.00 |

| NAV per share | 13.27 |

| RONW | 7.51% |

| EBITDA | 70.77% |

| PAT Margin | 15.18% |

| Price to earning (PE) | 235.00 |

| Debt to Equity | 2.59 |

| Adani Ports | JSW Infra |

|---|---|

| 26,710.56 | 3,762.89 |

| 8,103.99 | 1,160.69 |

| 37.55 | 5.88 |

| 245.10 | 41.77 |

| 15.32% | 14.40% |

| 59.39% | 52.21% |

| 28.73% | 28.78% |

| 37.48 | 49.02 |

| 0.85 | 0.53 |

- All information pertains to FY 2023-24.

- The PE ratio is calculated using the Upper Price Band for the Issuer and the closing price as of May 16, 2025 for Peers

Promoter Details

| Name | Shareholding |

|---|---|

| Aegis Logistics Limited | 50.10% |

| Vopak India B.V. | 47.31% |

| Total | 97.41% |

Management Details

| Name | Designation |

|---|---|

| Raj Chandaria | Chairman & MD |

| Manoj Sharma | CFO |

Company Details

Name: Aegis Vopak Terminals Limited

Address: 502, Skylon, G.I.D.C, Char Rasta, Vapi, Valsad – 396 195, Gujarat, India

Number: +91 22 4193 6666

Email: secretarial@aegisindia.com

Website: www.aegisvopak.com

Book Running Lead Managers (BRLMs)

Jefferies India

Visit Website

HDFC Bank

Visit Website

ICICI Securities

Visit Website

IIFL Capital Services

Visit Website

BNP Paribas

Visit WebsiteRTAs

MUFG Intime India

Visit WebsiteFrequently Asked questions?

Find answers to common questions that come in your mind related to IPO.

Aegis Terminals IPO is a Mainboard IPO having an issue size of Rs. ₹3,500.00 Crs. Aegis Terminals IPO is priced at ₹223 - ₹235 per share. The issue opens on 26 May 25 and closes on 28 May 25.

Aegis Terminals IPO opens on 26 May 25 and closes on 28 May 25.

The estimated Grey Market Premium of Aegis Terminals IPO is ₹2 per share (0.85%).

The minimum lot size of Aegis Terminals IPO is 63 shares & the minimum application amount is Rs. 14805.

The allotment date of Aegis Terminals IPO is 29 May 25.

The listing date of Aegis Terminals IPO is 02 Jun 25.

Aegis Terminals IPO is subscribed 2.09 times.

Aegis Terminals IPO is priced at ₹223 - ₹235 per share.

Click the allotment link on Aegis Terminals IPO page of IPO360.

- Go to Kite App → Tap on Bids → Tap on IPO

- Select the IPO → Tap on apply → Enter UPI ID

- Enter Qty and Price

- Submit the application

- Approve the UPI Mandate on your UPI app

- Go to Groww App → Stocks Section → Select IPO option

- Select the IPO you want to apply

- Enter your bid details and price

- Enter UPI ID & submit

- Approve the UPI Mandate on your UPI app

- Log in to your bank's net banking portal.

- Navigate to the 'IPO' or 'ASBA' section.

- Select Aegis Terminals IPO from the list of available IPOs.

- Enter the required details: Bid quantity, Price, DP ID & Client ID, etc

- Submit the application.

- Money will remain blocked till the refund date